Bay37 by Pulte Homes

15 Homes have been sold

only 5 two-bedroom homes / 1 one-bedroom home Left!

Opportunity Drawing Announcements

These Homes will be sold via the Lottery System (Randomly Assigned Numbers) with City Preferences, facilitated by HouseKeys on its online platform, https://www.myhousekeys.com/.

7/25/2025 Solar is included in the price!

PROGRAM DOCUMENTS & DISCLOSURES

Resale Restriction, Excess Sales Proceeds Note, and Deed of Trust

This program requires you to sign a Restriction Agreement with a 59-year term.

Understanding the intricacies of the program documents is crucial when considering participation in a housing program. Deed restrictions, agreements, promissory notes, and deeds of trust are all legal instruments that can significantly impact the rights and obligations of property owners. For instance, deed restrictions can limit how a property is used, who you can sell it to, refinancing, and upgrading the home, and it requires the owner to occupy the home. It also sets conditions for its future sale, which includes a cap on the resale value and/or an equity share, depending on the program. Similarly, a promissory note is a binding promise to repay a loan and/or excess sales proceeds (the difference between the home's fair market value and the maximum restricted resale price), and a deed of trust secures the promissory note by placing a lien on the property. Click below to access & review the documents to ensure this program is for you. You can hire an attorney to help you understand the Program Documents you’ll sign and promise to abide by.

OPPORTUNITY DRAWING #703

All units are designated for Moderate-income households who earn up to 120% of the Area Median Income.

Mello roos / special bond tax applies to all homes - Approximately $500/month. Please confirm with your loan officer.

Solar Requirements: 7.25.25 Included in price!

Resale Restriction Terms: 59 Years (Review the documents above)

City Preferences: Yes. You may still apply if you don’t meet them.

Please refer to the ODN (Right) for additional information

2 Bedroom Homes

5 units

1.5 Bathroom

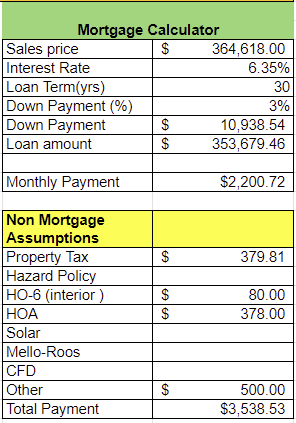

Sales Price: $364,618

HOA: $378 (some will drop at build-out; see notice for details)

Approx. 910 to 1138 sq. ft.

1 Car Garage

Minimum Occupancy: 2 persons

Important Deadlines

We are now accepting backup applicants. If you are interested in being a backup applicant for this drawing, fill out the form below by August 27th, 5 pm.

Estimated minimum household income: $94,361

ESTIMATED COST BREAKDOWN

Loan Pre-approvals or Pre-qualification Letters by an unregistered lender will not be accepted and delay your review process. Select one from the HouseKeys Registered Lender List (click HERE to find the list). In addition to the HOA monthly fees, Taxes, and Insurance, please ask your loan officer to include the additional non-mortgage payments, including the mello roos / special bond tax*. We encourage you to speak with your loan officer about the estimated TOTAL monthly payment to make sure you can afford it.

HOA Dues cover the following…

All common areas are maintained including: The exterior maintenance and repair of the building (roof, paint, gutters, railings, balconies)

Hazard Insurance on the exterior structure of the building.

A portion of each owner’s HOA goes to the Alameda Transportation Management Association for Shuttle Services and to help address and assist with public transportation needs

Maintenance and regular inspections of fire sprinkler/suppression systems

All common area landscaping in and around each building and community parks.

Streets – (all private only) – maintained and repaired

Lighting, benches, garbage cans, mailboxes, etc.

Pocket Parks – Bay37 Community pocket parks

Mitchell Greenway

Waterfront Park will be a public park that is maintained by the City. – Amenities include a children’s play area, picnic tables, BBQ, and outdoor exercise equipment.

Common area Utilities

Management fees long-term reserves requirements

RESOURCES

Register for HUD Approved 1st Time Homebuyer course

Lender List and Forms: Click Here

Please do not visit or contact the Pulte sales office. HouseKeys will invite selected applicants to a Below Market Rate Program Open House.

City Preferences

Applicants must select the City Preferences by the Drawing Entry deadline and submit proof they meet them by the File Submission Deadline. The Final Ranking number is subject to change after preferences are verified. Applicants cannot adjust their City Preference Tiers/Points after the Drawing Entry Deadline. Preference Tiers/Point adjustments or corrections by the applicant after the Drawing Entry Deadline will not be considered. The Preference will be invalidated if supporting documents are not submitted on time or if insufficient proof is submitted.

landing (flats)

Six units

lookout (rows)

Nine units

Please do not visit or contact the Pulte sales office. HouseKeys will invite selected applicants to a Below Market Rate Program Open House.

Rich in history with beautiful waterfront views, Bay37 in Alameda will feature new construction homes, townhomes, and condos with Life Tested® floor plans, smart home features, modern architecture, and energy-efficient construction. This new home community in the Bay Area will boast a variety of amenities for residents including picnic areas, a playground, a public dock, walking paths along the estuary, and more! A total of 357 homes will be built in this community.